Salesforce Financial Services cloud

Energize your customer relationships with 360 – degree digital experiences that redefine the banking experience.The banking industry faces a challenge to meet and exceed customer expectations. It is important to work with banking solutions that align with their customer’s lifestyles.

Studies show that 49% of consumers feel that their bank doesn’t understand their needs.

(Source: Salesforce, 2017 Connected Banking Customer Report)

Further, legacy system silos create a further disconnect for the customer. It restricts innovation and doesn’t allow the bank to offer customer centric solutions that can be managed centrally

Salesforce Banking Solutions

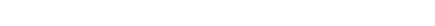

With Salesforce, you have a partner who recognizes this demand and has created a solution that will enable you to create a digital experience that customers love. Salesforce financial services cloud empowers banks to meet this challenge head on. It offers a 360-degree view of customers’ financial transactions and their requirements. With the help of Service Cloud Digital Engagement, this view can be extended into real-time interactions across a wide range of channels as per the customers’ preferences.

The Marketing Cloud and Customer portals help improve on these relationships and offer a personalized journey for each user and optimizing the value for both the bank and the customer.

Why Salesforce Financial Services Cloud is right for you

The Salesforce Financial Services Cloud works to empower the banking industry with solutions that work.

Offer personalized experiences

With the 360 customer view, it is possible to keep track of customers needs and goals. The relationship builder and visual map options allow you to track their household as well as business networks for a refined and holistic experience. The intelligent analytics offer needs-based referrals that will help deepen your relationship with your customer.

Further, with the power of Einstein analytics, you can prioritize key relationships and nurture your top referrers while at the same time addressing the needs of the referrals in real-time.

Innovation

Salesforce is constantly in touch with industry leaders and the changing needs of customers. With new product features and enhancements that are integrated automatically to the financial services platform, users can rest assured that they are getting continuous access to cutting edge developments to keep them ahead of the curve.

It is also easier to speed up implementation on an agile technology platform to keep up with rapidly changing customer expectations and needs.

Salesforce has revitalized the conversation about customer engagement and promoted the vision of a ‘Connected Bank’ with their wide network of partners, employees and customers who trust them to offer an efficient and futuristic experience in the banking industry.

Also of interest

-

Are you ready to migrate from Salesforce Classic to the Lightning experience?

Check out our 10 point best practices method to plan a smooth migration that will seem tailor made just for you. read more

-

Six Consulting Inc. in Clutch 2018 Top B2B IT & Business Services List

We're thrilled to be announce that Six has just been named one of the top system integrators on Clutch read more

-

Team Six at the GMSDC Spirit of Alliance Awards night

Our team was excited to be a part of the awards night celebrating supplier diversity read more